Mastering Financial Fluency: The Indispensable Role of Banking Vocabulary Worksheets

The world of finance is a complex tapestry woven with intricate concepts, regulatory frameworks, and specialized terminology. For anyone looking to navigate this landscape – be it a student aspiring to a career in finance, an English as a Second Language (ESL) learner aiming for clarity in financial dealings, a professional seeking to enhance their communication, or even an individual simply trying to understand their bank statements – the sheer volume of jargon can be an intimidating barrier. This is where banking vocabulary worksheets emerge as an invaluable, indispensable tool. More than just a list of words, these worksheets are structured learning aids designed to demystify financial language, build confidence, and empower individuals to engage effectively with the banking sector.

The Indispensable Role of Banking Vocabulary Worksheets

In an increasingly globalized economy, accurate and precise communication in banking is not merely a convenience but a necessity. Misunderstandings stemming from unfamiliar terminology can lead to significant financial errors, legal complications, or missed opportunities. For instance, confusing "interest rate" with "APR" or "collateral" with "capital" can have profound implications. Banking vocabulary worksheets serve as a critical bridge between general English proficiency and the specific linguistic demands of the financial industry. They provide a focused environment for learners to acquire, practice, and internalize terms that are unique to banking, ensuring that they can comprehend financial documents, participate in discussions, and articulate their needs or advice with clarity and confidence.

These worksheets are not just for those new to the field; experienced professionals often use them to stay updated with evolving terminology, especially in rapidly changing areas like FinTech or compliance. They reinforce learning, identify knowledge gaps, and ultimately contribute to a more competent and articulate workforce.

Who Benefits Most from Banking Vocabulary Worksheets?

The utility of banking vocabulary worksheets extends across a broad spectrum of learners and professionals, each group finding unique advantages:

-

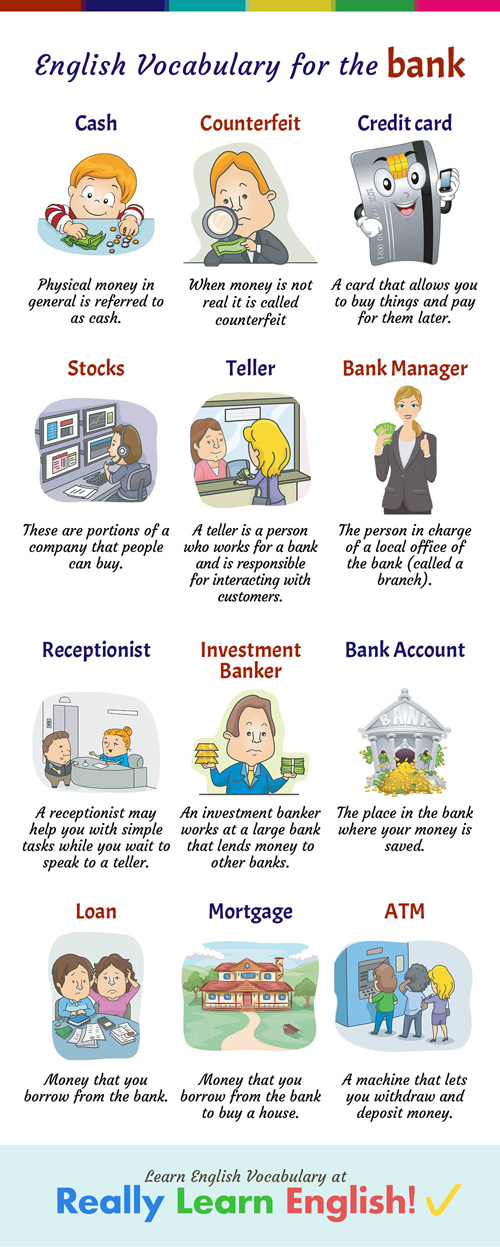

ESL Learners: For individuals whose native language is not English, financial concepts can be doubly challenging when presented in a foreign tongue. Worksheets provide a structured, repetitive, and contextualized way to learn terms like "mortgage," "deposit," "withdrawal," "loan," "credit score," and "checking account." They help bridge the linguistic and conceptual gap, enabling ESL learners to manage their personal finances, understand banking services, and even pursue careers in finance in English-speaking environments.

-

Finance Students: Whether at the undergraduate or postgraduate level, students pursuing degrees in finance, economics, business administration, or accounting require a robust understanding of banking terminology. Worksheets complement theoretical learning by providing practical exercises that solidify their grasp of concepts like "derivatives," "equities," "fixed income," "liquidity," "asset management," and "risk assessment." This mastery is crucial for academic success, research, and future professional practice.

-

Job Seekers in Finance: Preparing for interviews in the banking sector demands not only knowledge of financial concepts but also the ability to articulate them fluently. Worksheets tailored to interview scenarios can equip candidates with the precise vocabulary needed to discuss market trends, financial products, regulatory changes, or their understanding of specific banking roles. Terms such as "due diligence," "portfolio diversification," "mergers and acquisitions," and "financial modeling" become second nature, giving candidates a competitive edge.

-

Banking Professionals: From customer service representatives to investment bankers and compliance officers, all banking professionals benefit from continuous vocabulary enhancement. Worksheets can be used for internal training, onboarding new employees, or upskilling existing staff on new products, services, or regulatory updates. For instance, a new digital banking platform might introduce terms like "blockchain ledger," "cryptocurrency wallet," or "API integration," which require dedicated learning.

-

General Public: Even individuals not directly involved in the finance industry can greatly benefit. Understanding terms like "interest rates," "inflation," "credit score," "budgeting," "savings accounts," and "investment funds" empowers them to make informed personal financial decisions, avoid scams, and engage more confidently with their banks. Financial literacy begins with understanding the language.

Types of Vocabulary Covered in Banking Worksheets

The scope of banking vocabulary is vast and can be categorized into various levels and specialized areas:

- Basic/Retail Banking: This includes everyday terms related to personal banking, such as: account, deposit, withdrawal, balance, ATM, debit card, credit card, loan, mortgage, interest, savings, checking, statement, transaction, overdraft, online banking.

- Intermediate/Commercial Banking: Terms related to business accounts, small business loans, and basic investment concepts: line of credit, collateral, equity, principal, interest rate, amortization, financial statement, cash flow, profit, loss, budget, revenue, expenditure, dividend, stock, bond, mutual fund.

- Advanced/Investment & Corporate Banking: Complex terms used in capital markets, corporate finance, and wealth management: derivatives, futures, options, swaps, hedge fund, private equity, IPO (Initial Public Offering), M&A (Mergers and Acquisitions), underwriting, portfolio, diversification, arbitrage, volatility, liquidity, yield, benchmark, compliance, regulation, KYC (Know Your Customer), AML (Anti-Money Laundering).

- Digital Banking & FinTech: Emerging terms related to technological advancements in finance: blockchain, cryptocurrency, digital wallet, peer-to-peer lending, AI (Artificial Intelligence) in finance, machine learning, robo-advisor, open banking, API (Application Programming Interface), cybersecurity.

- Regulatory & Compliance: Terms related to the legal and ethical frameworks governing banking: Basel Accords, Dodd-Frank Act, GDPR (General Data Protection Regulation), audit, due diligence, anti-money laundering (AML), sanctions, governance, transparency, risk management.

Diverse Formats of Effective Banking Vocabulary Worksheets

The versatility of banking vocabulary worksheets lies in their diverse formats, each designed to engage learners in different ways and reinforce understanding:

-

Matching Exercises: This common format involves matching a financial term with its definition or an example sentence. It’s excellent for initial learning and quick recall.

- Example: Match "Mortgage" with "A loan taken out to buy a house."

-

Fill-in-the-Blanks: Learners complete sentences using appropriate banking terms from a given word bank. This encourages contextual understanding.

- Example: "When you put money into your account, it’s called a _____." (deposit)

-

Multiple Choice Questions: This format tests comprehension by requiring learners to select the correct definition or usage of a term from several options.

- Example: "Which of the following best defines ‘collateral’?" a) A type of interest b) An asset pledged as security for a loan c) A bank’s profit d) A type of bank account.

-

True/False Statements: Learners evaluate statements about financial terms for accuracy, promoting critical thinking.

- Example: "APR stands for Annual Percentage Rate." (True)

-

Crosswords and Word Searches: These gamified formats make learning fun and help with word recognition and spelling. They are particularly effective for reinforcing terms already introduced.

-

Sentence Completion/Construction: Learners use specific banking terms to create their own sentences, demonstrating their ability to use the vocabulary correctly in context.

- Example: Use "liquidity" in a sentence that demonstrates its meaning.

-

Role-Playing Scenarios: For more advanced learners, particularly those in customer service or sales roles, worksheets can include short scripts or scenarios (e.g., a customer opening an account, applying for a loan). Learners practice using the vocabulary in simulated real-life conversations.

-

Case Studies/Contextual Exercises: These involve reading a short financial news article or a business case and then answering questions that require the application of specific banking terms. This high-level exercise promotes analytical thinking and real-world application.

Designing and Sourcing Quality Banking Vocabulary Worksheets

For educators, trainers, or even self-learners, creating or finding effective banking vocabulary worksheets requires attention to detail:

- Define Your Audience: Tailor the vocabulary level and complexity to the target learners (e.g., basic for general public, advanced for finance students).

- Select Relevant Terms: Focus on words and phrases that are frequently used and essential for comprehension within the specific banking domain being studied.

- Provide Clear Definitions: Ensure definitions are concise, accurate, and easy to understand, avoiding circular definitions or overly technical language themselves.

- Include Contextual Examples: A term’s meaning is best understood when seen in a sentence or a short paragraph.

- Vary Exercise Formats: Incorporate a mix of the formats mentioned above to keep learners engaged and test different aspects of comprehension.

- Include Answer Keys: This is crucial for self-correction and independent learning.

Quality worksheets can be sourced from various places:

- Educational Platforms: Websites specializing in ESL, business English, or finance education often offer downloadable resources.

- Textbooks and Curricula: Many finance and business English textbooks include dedicated vocabulary sections and exercises.

- Financial News Outlets: While not worksheets directly, articles from reputable financial news sources (e.g., The Wall Street Journal, Financial Times, Bloomberg) can be adapted into contextual vocabulary exercises.

- Custom Creation: For specific needs, creating bespoke worksheets allows for perfect alignment with learning objectives.

Maximizing the Effectiveness of Banking Vocabulary Worksheets

Simply completing a worksheet isn’t enough; maximizing its learning potential requires a strategic approach:

- Contextual Learning: Always strive to understand words within sentences or real-life scenarios rather than just memorizing definitions in isolation.

- Active Recall: Instead of just reviewing definitions, actively test yourself. Cover the definitions and try to recall them from memory, or explain the term in your own words.

- Regular Review: Spaced repetition – revisiting vocabulary at increasing intervals – significantly improves retention.

- Application: Use the newly learned vocabulary in conversations, writing, or when analyzing financial news. The more you use it, the more it becomes part of your active vocabulary.

- Personalization: If a term is particularly challenging, try associating it with an image, a personal experience, or a mnemonic device.

- Combine with Other Resources: Use worksheets in conjunction with financial podcasts, documentaries, news articles, and even bank visits (if appropriate) to see and hear the vocabulary in action.

The Future of Financial Literacy and Vocabulary Learning

As the banking industry continues to evolve at a rapid pace, driven by technological innovations like AI, blockchain, and open banking, the vocabulary associated with it will also expand and shift. This necessitates a continuous learning approach. The beauty of banking vocabulary worksheets is their adaptability; they can be updated to include new terms, reflect changes in financial products, or address emerging regulatory concerns.

In an era where financial decisions are increasingly complex and digital, equipping individuals with the precise language to understand and interact with this world is more important than ever. From fostering personal financial literacy to empowering global professionals, the continued relevance and evolution of banking vocabulary worksheets will be paramount in bridging the communication gap and ensuring financial fluency for all.

In conclusion, banking vocabulary worksheets are far more than just study aids; they are gateways to understanding, confidence, and opportunity within the expansive and crucial domain of finance. By systematically breaking down the language barrier, they empower individuals to navigate the banking world with clarity, precision, and ultimately, success.